The Best Strategy To Use For Property By Helander Llc

The Best Strategy To Use For Property By Helander Llc

Blog Article

Get This Report on Property By Helander Llc

Table of ContentsSome Ideas on Property By Helander Llc You Need To KnowEverything about Property By Helander LlcThe Best Guide To Property By Helander LlcTop Guidelines Of Property By Helander LlcThe Facts About Property By Helander Llc UncoveredThe Best Strategy To Use For Property By Helander Llc

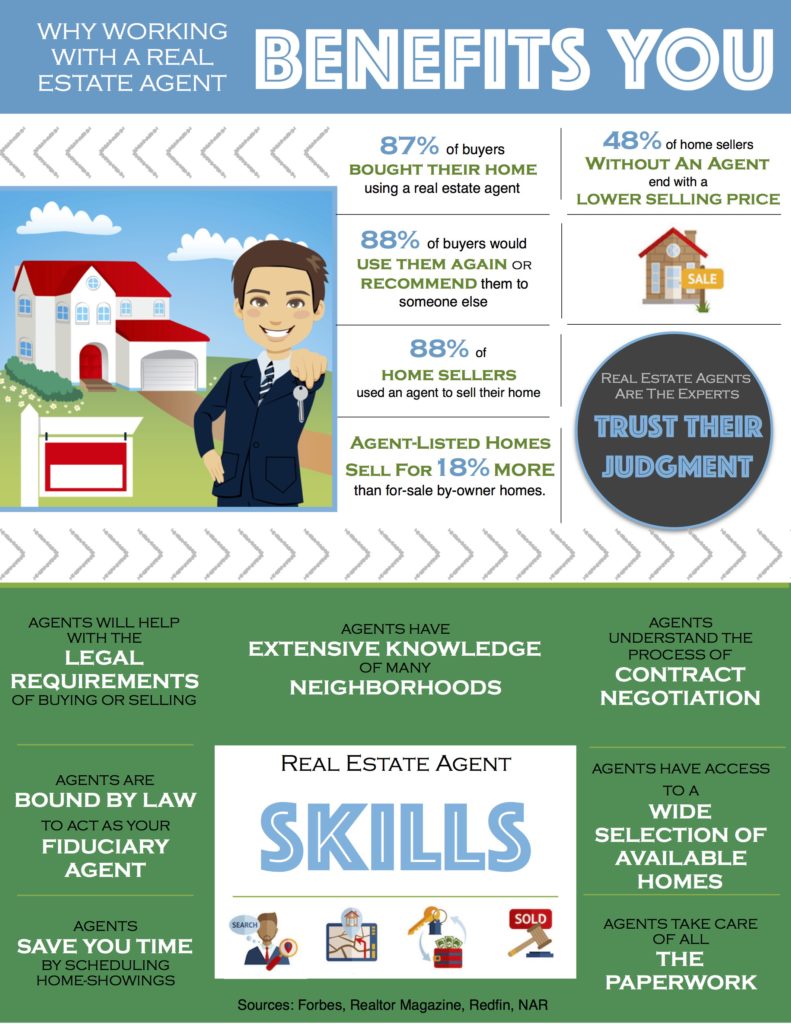

The benefits of investing in actual estate are countless. Below's what you require to understand regarding actual estate advantages and why genuine estate is considered a great financial investment.The advantages of spending in actual estate consist of easy income, secure cash circulation, tax advantages, diversification, and take advantage of. Genuine estate investment trusts (REITs) supply a means to invest in actual estate without having to own, run, or finance buildings.

In a lot of cases, cash money flow only reinforces over time as you pay for your mortgageand develop your equity. Investor can capitalize on numerous tax obligation breaks and reductions that can conserve cash at tax time. In general, you can deduct the practical expenses of owning, operating, and handling a home.

The Buzz on Property By Helander Llc

Actual estate values often tend to raise gradually, and with a great financial investment, you can profit when it's time to market. Leas additionally tend to increase gradually, which can cause greater cash money circulation. This graph from the Federal Reserve Financial Institution of St. Louis reveals typical home prices in the U.S

The areas shaded in grey indicate united state recessions. Average Prices of Residences Marketed for the USA. As you pay for a building home loan, you build equityan possession that belongs to your total assets. And as you develop equity, you have the leverage to get even more buildings and enhance cash money flow and riches much more.

Because real estate is a tangible property and one that can serve as security, financing is conveniently available. Actual estate returns differ, depending on variables such as location, possession class, and administration.

5 Simple Techniques For Property By Helander Llc

This, subsequently, converts into greater resources values. Consequently, genuine estate tends to preserve the purchasing power of funding by passing some of the inflationary stress on renters and by incorporating several of the inflationary stress in the kind of resources recognition. Home loan lending discrimination is illegal. If you believe you have actually been victimized based upon race, religious beliefs, sex, marriage status, use of public support, nationwide beginning, disability, or age, there are steps you can take.

Indirect real estate investing entails no direct ownership of a home or homes. There are numerous means that having actual estate can shield against inflation.

Residential properties financed with a fixed-rate car loan will see the family member amount of the monthly home mortgage payments drop over time-- for circumstances $1,000 a month as a fixed settlement will certainly come to be less challenging as rising cost of living deteriorates the acquiring power of that $1,000. (https://www.wattpad.com/user/pbhelanderllc). Typically, a key residence is ruled out to be a realty investment considering that it is used as one's home

Property By Helander Llc Fundamentals Explained

Despite the assistance of a broker, it can take a couple of weeks of job simply to find the best counterparty. Still, realty is an unique asset class that's straightforward to recognize and can boost the risk-and-return profile of a financier's portfolio. On its own, realty supplies cash money circulation, tax breaks, equity structure, competitive risk-adjusted returns, and a hedge versus rising cost of living.

Purchasing realty can be an exceptionally fulfilling and profitable undertaking, however if you resemble a whole lot of new capitalists, you might be wondering WHY you should be investing in genuine estate and what benefits it brings over various other financial investment opportunities. In addition to all the incredible benefits that come along with investing in real estate, there are some disadvantages you require to take into consideration.

The Best Strategy To Use For Property By Helander Llc

If you're trying to find a method to buy right into the property market without having to spend thousands of thousands of bucks, have a look at our properties. At BuyProperly, we utilize a fractional ownership model that enables investors to begin with just $2500. An additional major advantage of check my site realty investing is the capacity to make a high return from purchasing, remodeling, and reselling (a.k.a.

Rumored Buzz on Property By Helander Llc

If you are billing $2,000 lease per month and you sustained $1,500 in tax-deductible expenditures per month, you will just be paying tax on that $500 profit per month (realtors in sandpoint idaho). That's a big distinction from paying taxes on $2,000 each month. The revenue that you make on your rental for the year is considered rental revenue and will certainly be strained accordingly

Report this page